l was amused at the comments l received yesterday following my post on how l define the difference between tax avoidance and tax planning. Here is some of the post:

I was asked yesterday by a pretty experienced tax journalist how I defined the difference between tax planning and tax avoidance.

“That”, I said “is easy. It’s getting legal opinion.” And I put down the phone.

What did I mean? Well, I meant that the UK tax system is so straightforward and simple that nobody in their right mind would need to get legal opinion unless they were doing something malicious.

Remember, this is how I define tax avoidance. This is not simply some heuristic or intermittent indicator. This is no sloppy rule of thumb.This is how I openly say that I distinguish tax avoidance from tax planning. Not just in passing either. I say this to journalists in my professional capacity. And then I blog about the conversation on my website so that nobody is any doubt that this is what I consider the absolute definition of tax avoidance to be.

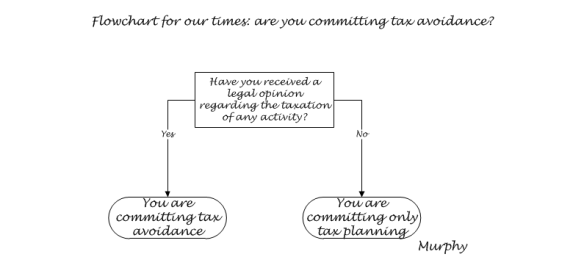

In the face of the usual neoliberal outpourings of misunderstandings, l even clarified my view in unambiguous diagramatic format.

Candidly, l cannot imagine how I could have been any more explicit. Many of the normal trolls have been saying that I have said that the definition of the difference between tax avoidance and tax planning is getting legal opinion.

l said no such thing as is readily apparent from my careful choice of words and use of nuance. If anything, what I gave was a heuristic or a useful rule of thumb.

By saying unambiguously that getting legal opinion is the definition of the difference between tax avoidance and tax planning, in a professional capacity to a journalist remember, I was simply expressing the view that tax avoidance may or may not involve getting legal advice, as may tax planning.

Of course, nobody in their right mind would suggest that obtaining legal opinions on tax matters is in anyway indicative of tax avoidance. We have a system of self-assessment where the onus is on the taxpayer to ensure their affairs are taxed correctly. Only some sort of Nazi would suggest that anybody who seeks a legal opinion in performing that task should be identified as morally reprehensible in some way and subject to persecution.

No, l simply stated the rule of thumb that, getting a legal opinion may, or may not, indicate that something is either tax avoidance or tax planning.

Or maybe just tax compliance.

What people don’t understand is that what I expressed is heuristic logic. That means I’ve seen legal opinions obtained in the course of tax avoidance.

Of course, I’ve seen legal opinions obtained not in the case of tax avoidance. But I didn’t say that. I was just talking about legal opinions in relation to the avoidance. I didn’t mention tax planning or, indeed, the difference between tax avoidance and tax planning. So anybody who is saying that l said such things about legal opinion being a distinction is just lying.

If anything, the fact that they are lying and pointing out legitimate non-avoidance uses of legal opinions on taxation just proves my original point because the multitude of examples they cite don’t count.

So, dear sophists, stop making fools of yourselves on the internet by trying to promote your half-baked drivel at every opportunity and just making up stuff on the spot and trying to get it published.

Perhaps you could just try admitting, just for once, that you were talking out of your backside? Yes? Sounds good to me.

It is alegal to not press one of these buttons: